accumulated earnings tax c corporation

An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income.

Is Corporate Income Double Taxed Tax Policy Center

Texas Tax Obligations.

. A regular corporation also known as a c-corporation is subject to corporate taxes and must file tax returns Form 1120 each year. If and only if the shareholders receive a dividend from. S corporations that have.

Internal Revenue Code section 532a applies the accumulated earnings tax to corporations that accumulate earnings and profits beyond an amount needed to meet reasonable business. The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys. A regular corporation or C corporation pays tax on its earnings at the corporate level.

Private and publicly held corporations are subject to this tax but it does not impact passive foreign investment companies tax-exempt organizations and personal holding. The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in. Schedule M-3 is used by certain corporations and partnerships to.

Publication 542 012019 Corporations - IRS tax forms. As of the writing of this article the Trump Tax plan would reduce the Corporate tax rate to 21. Then a second tax is paid when those same earnings are distributed as.

A Personal Services Company PSC can make profits of up to 150000 without having to pay these fees. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond. Find tax information for corporations including compliance filing requirements the examination process FATCA.

As the difference between ordinary income tax rates and capital gains tax rates increases corporations have sought to minimize dividend payments to shareholders with the. The tax rate on accumulated earnings is 20 the maximum rate at. Accumulated EP was taxed at the C corporation level and will be taxed again as a dividend to recipient S corporation shareholders when distributed.

Texas does not impose an income tax on corporations nor does it impose an. Small businesses have two common taxes employment and sales tax. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

This means the LLC will file a corporate tax return and pay corporate taxes on the profits. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. What is the Accumulated Earnings Tax.

However if a corporation allows earnings to accumulate. When the C corporation has current retained or accumulated earnings and profits EP non-liquidating corporate distributions to shareholders are considered as. C corporations can earn up to 250000 without incurring accumulated earning tax.

In January you use the worksheet in the Form 5452 instructions to figure your corporations current year. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of.

Is Corporate Income Double Taxed Tax Policy Center

How Directors Use Shareholder Dividends To Build Owner Value

Determining The Taxability Of S Corporation Distributions Part Ii

What Are Accumulated Earnings Definition Meaning Example

Earnings And Profits Computation Case Study

What Are Retained Earnings Guide Formula And Examples

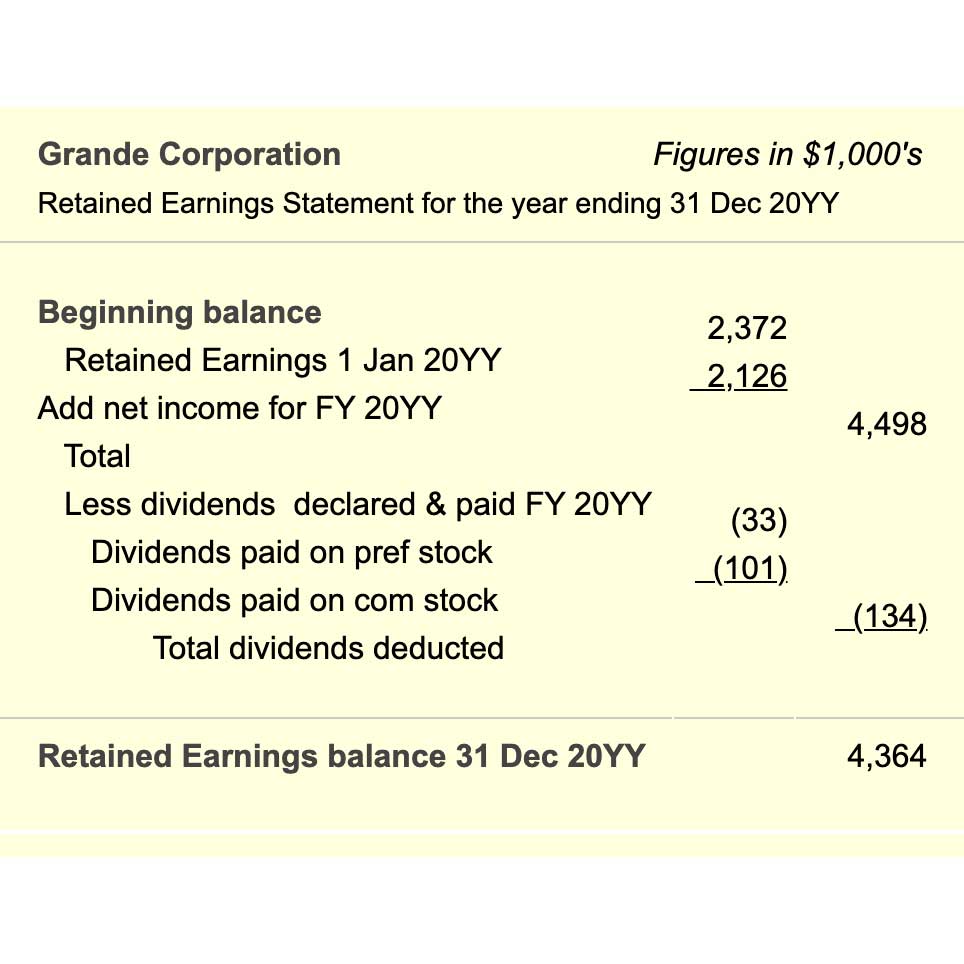

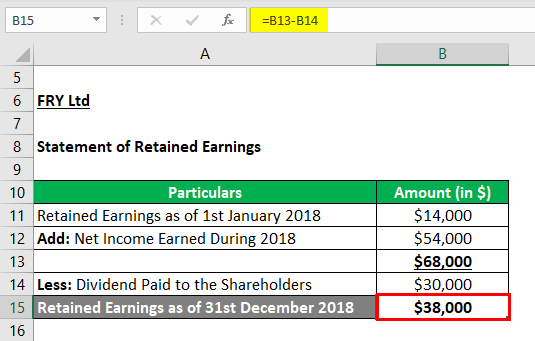

Statement Of Retained Earnings Example Excel Template With Examples

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Oh How The Tables May Turn C To S Conversion Considerations Stout

Earnings And Profits Computation Case Study

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Earnings And Profits Computation Case Study

Determining The Taxability Of S Corporation Distributions Part I